Life insurance is something that everybody needs, but nobody wants to think about. It’s confusing, scary, and emotional, especially if you’re going into it without a plan. As you go through life – get married, start a family, open a business – you learn that life insurance is a NECESSITY in order to protect the ones that you love. How can you make the most of your life insurance? Read ahead to find out!

Life insurance is something that everybody needs, but nobody wants to think about. It’s confusing, scary, and emotional, especially if you’re going into it without a plan. As you go through life – get married, start a family, open a business – you learn that life insurance is a NECESSITY in order to protect the ones that you love. How can you make the most of your life insurance? Read ahead to find out!

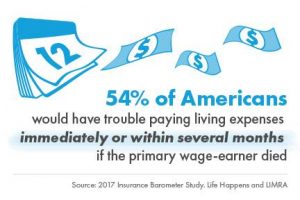

- Why is it so important to have life insurance? Life insurance isn’t about YOU. It’s about the LIVING, those you leave behind – your kids, husband or wife, your business. Think of purchasing life insurance as an act of love and caring, an investment in their future. If you passed prematurely, wouldn’t you want your loved ones to be protected? To leave them prepared for what the future may bring? Life insurance covers your children and their college fund. It covers your mortgage, your marriage, and acts as an income replacement after a spouse’s death. In a time when emotions are high and decisions are made quickly, it gives your family some breathing room. Debts can be paid, housing accommodations can

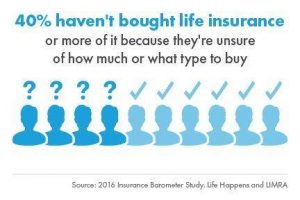

- How long are you going to need it? Do you buy TERM insurance or Permanent? How long are the above REASONS going to last? Some of them (such as your mortgage) may only last a few years, while others last a lifetime. So how do you know which kind of policy to choose? Term life insurance pays for death benefits only (and only if you pass while the term is in effect). It’s easy and affordable, customizable (you choose the time period or “term” you would like), and can be converted into a whole (permanent) life insurance policy if you choose. Whole insurance covers you for life. The initial premiums are higher than term insurance, but can gain you more in the long run. While it takes time to build, it can leave you with a financial legacy. You’re also able to borrow funds when needed (to pay for college or other expenses that might come up). If you’re unsure of which type of policy is best suited for you, visit with your agent to get informed. There are variables to weigh for each type of policy, and they can help guide you in the right direction for protecting your future.

- When should you buy? Did you know that the optimal age to purchase life insurance is under 35? Life insurance isn’t something to sit on. Purchase it as soon as you can. Policies get more expensive with each passing year, so the longer you wait, the higher the rates. Are you in good health today? It’s hard to think about, but you might not be tomorrow. Don’t wait until it’s too late – buy it NOW! The cost is small compared to what it covers.

- How much coverage do I need? This one requires some thought! $500,000 in coverage may sound like a lot, but does it cover everything? Take the time to ask yourself a few questions before you make a decision: How much debt do you have? Is it just your mortgage, or do you have other debts? Are you able to pay them off or are they building every month? Factor that in when making a decision! How much do you spend monthly? This is great to look into even if you’re not considering life insurance! It never hurts to see what you’re spending and learn how to budget. Are you saving every month? How much? You might need less coverage if you’re able to save and not live paycheck to paycheck. What are your financial goals for your family’s future? Think about what you need to save for college, weddings, moves, retirement, etc.

- Get a PLAN together Don’t buy one policy now and one in five years etc- it costs a LOT more to do it piecemeal. Take the time to plan it out. It may not be enjoyable, you might even hate it if you’re not the planning type. But, it will save you BIG TIME.

Still have questions? Ask us!!! You need someone who CARES to take the time to help you. Life insurance is a BIG HUGE deal, especially since it’s not completely about YOU. It’s about everyone who depends on you, and they are your EVERYTHING. If a policy is done right it can give your family peace of mind, help them settle into a new lifestyle, and set them on a successful financial path for the future. If it’s done wrong? You don’t even want to think about that – you could lose your house, your bank account, your vacations with the kids. You need someone who is MORE interested in your welfare than their paycheck. Get in touch with O’Brien Insurance today to get started – you can’t put a price on protection!

Still have questions? Ask us!!! You need someone who CARES to take the time to help you. Life insurance is a BIG HUGE deal, especially since it’s not completely about YOU. It’s about everyone who depends on you, and they are your EVERYTHING. If a policy is done right it can give your family peace of mind, help them settle into a new lifestyle, and set them on a successful financial path for the future. If it’s done wrong? You don’t even want to think about that – you could lose your house, your bank account, your vacations with the kids. You need someone who is MORE interested in your welfare than their paycheck. Get in touch with O’Brien Insurance today to get started – you can’t put a price on protection!